Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

2021 is the first year of the Energy Storage policy.

Facing the trend of "carbon neutrality", a series of energy storage policies have been introduced frequently, far exceeding expectations. Lithium, photovoltaic, wind power, central energy enterprises and other players have been involved in new energy storage, showing a lively scene.

However, from the current industrial practice and relevant data of listed companies, energy storage business is not as bright as it seems. With low base and high growth, it is affected by factors such as upstream material cost rising, downstream investors wait-and-see, intensified competition and so on, and its gross profit margin declines and profitability is generally not strong.

At present, new energy storage is optimistic in terms of business quantity, but unsatisfactory in terms of business quality. The market mechanism is not mature, and it is in the critical stage of evolution and upgrading from "quantity growth" to "quality growth".

Three Typical Players

New energy storage can be divided into power supply side, power grid side and user side in terms of application, but from the perspective of business model, it is more appropriate to divide it into three types of players, representing three different resource endowments:

One is the Lithium Battery system, such as Ningde Times, Paineng Technology, Ruipu Lanjun, etc. They have the core resource of electrochemical energy storage -- lithium battery. Meanwhile, energy storage is an important market segment of lithium battery enterprises, which is second only to power battery.

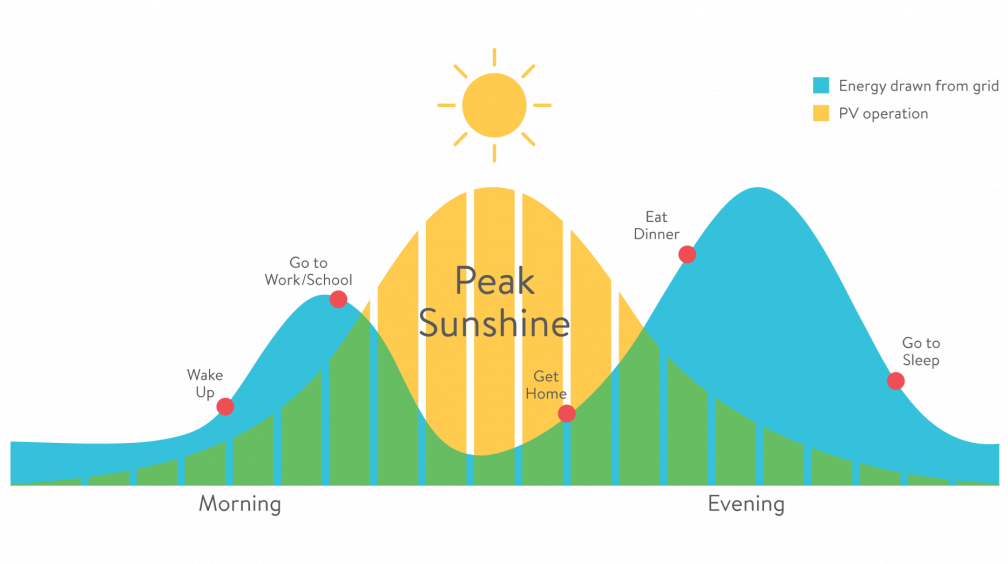

The second is photovoltaic/wind power system, such as Sunshine Power, Atos, Mingyang Intelligent, etc. They do not own upstream lithium, but have the market, brand and channel resources for energy storage business expansion. In particular, component, fan and inverter enterprises have innate advantages in new energy power supply side or distributed energy user side.

Third, independent third parties or independent brands with specific business resources, such as Wotai, Haibo and Zhiguang Energy Storage, do not own upstream lithium battery, but often have specific business resources in terms of market, brand, channel or integrated technology.

Different business positioning and business roles determine the profit model, industry chain discourse, profitability, competitive environment, business malleability and future development potential of energy storage business, which can be seen from a-share related listed companies.

A - share performance of three typical listed companies

Today, there are many listed a-share companies involved in energy storage business, but they can all be grouped into the three players mentioned above.

Here, three typical listed companies are selected for analysis, among which Ningde Times and Peineng Technology are both lithium battery systems. However, Ningde Times mainly sells energy storage batteries, while Peineng Technology is more oriented to end users and mainly focuses on home energy storage, while solar power is mainly integrated with energy storage system as photovoltaic/wind power system. However, the business volume of independent third parties or independent brands in A-share listed companies is still relatively small, so there is no typical introduction here.

1. Ningde Era

Ningde Times is a typical representative of lithium battery energy storage. Its main application fields are power generation side and power grid side, and the user side is carried out through a joint venture with ATL.

In 2021, Ningde Times Energy storage system achieved operating revenue of 13.6 billion yuan, with a year-on-year growth of 601%; Accounted for 10.4% of the company's operating revenue, compared with 3.86% in the previous year; Gross margin was 28.52%, compared to 36.03% in the prior year; The sales volume was about 16.7GWh, up 599% year on year, accounting for 12.5% of the company's lithium battery sales volume.

According to calculation, the average sales price of Ningde Energy storage business in 2021 is about 0.81 yuan /Wh(excluding tax), which means that ningde Energy storage business is mainly delivered in the form of energy storage batteries rather than terminal energy storage systems.

In addition, this price level is unchanged from 2020, which means ningde Times energy storage business profitability has declined against the background of the upstream material cost surge, gross margin decreased 7.51% compared to the previous year.

However, compared with ningde Times power battery system gross margin of 22%, the gross margin of energy storage system business is higher, which also reflects the better profitability of energy storage business.

In recent years, Ningde Times attaches great importance to the development of energy storage business, and as the second largest business comparable to power battery, its growth rate is much higher than power battery. Last year, Ningde Times signed strategic cooperation agreements with National Energy Group, Sunshine Power supply, Atas and other enterprises.

2. Peoneng Technology

Peineng is also a lithium Battery Energy Storage System, but different from ningde era, Peineng mainly focuses on the field of user-side home energy storage, and has its own brand, directly facing the end customers.

In 2021, Energy storage business of Peoneng technology achieved operating revenue of 1.988 billion yuan (96.4% of the company's operating revenue), with a year-on-year growth of 90.4%. Gross margin 29.73%, compared with 43.65% in the year-ago period; Energy storage products sold by independent brands and OEM totaled 1456MWh, up 114% year-on-year.

Through calculation, the average sales price in 2021 is about 1.365 yuan /Wh(excluding tax), which also reflects that The energy storage business of Peoneng technology is mainly delivered in the form of energy storage system, directly facing the terminal.

However, in the context of the substantial increase in the cost of lithium materials, compared with the average sales price of 1.54 yuan /Wh(excluding tax) in 2020, the price dropped 11.36% year on year, resulting in a significant decline in gross margin, 13.92 percentage points lower than the same period last year. Under the influence of factors such as rising raw material prices and an intensified competitive environment, Paienergy's profitability has also declined.

3, sunshine power supply

As a typical representative of photovoltaic/wind power system energy storage, Sunshine Power Supply is mainly system integration business, and its application fields cover power supply side, power grid side and user side.

In 2021, sunshine power energy storage system achieved operating revenue of 3.14 billion yuan, with a year-on-year growth of 168.5%; Accounting for 13% of the company's operating revenue, compared with 6.1% in the previous year; Gross margin was 14.11%, compared to 21.96% a year earlier; Global shipments are about 3GWh.

The energy storage business of Sunshine Power is positioned as system integration, which is different from lithium energy storage enterprises, so the gross margin is relatively low. At the same time, the gross margin dropped sharply last year due to the failure to pay fines as agreed in the contract. According to the company, the gross margin has recovered to 20% in the first quarter of this year.

As A matter of fact, in addition to Ningde Times, Sunshine Power And Peineng Technology, other A-share listed companies, such as BYD, Guoxuan High-tech and other lithium enterprises, trina Solar energy, Mingyang Smart and other photovoltaic/wind power enterprises, as well as Zhiguang Electric, Colo Electronics and other related enterprises, are also involved in energy storage business, which will not be introduced here.

Several characteristics of current energy storage business

Through the relatively accurate data of A-share listed companies and the observation of energy storage business practice, we can see that the current energy storage business presents several characteristics:

First, the scale is growing rapidly, but from a low base. Ningde Times sales increased 601% year on year, Pai Neng Technology sales increased 114% year on year, sunshine power supply shipments increased 275% year on year, last year the three listed companies sales or shipments were 16.7GWh, 1456MWh, 3GWh.

Second, gross margin declined significantly. The gross profit margin of Ningde Times energy storage business decreased from 36.03% in 2020 to 28.52% in 2021, the gross profit margin of Energy storage business of Pieneng Technology decreased from 43.65% to 29.73%, and the gross profit margin of energy storage business of Sunshine power decreased from 21.96% to 14.11%.

Third, business model differentiation and clear. Ningde Times mainly sells energy storage batteries with an average price of about 0.81 yuan /Wh(excluding tax), while Peineng, also a lithium battery, mainly sells energy storage systems with an average price of about 1.365 yuan /Wh(excluding tax). However, due to less investment in fixed assets and higher material cost, the integrated energy storage system integration business has a lower gross profit margin. As the energy storage business continues to mature, each energy storage enterprise gradually defines its own advantages and disadvantages and business positioning.

Fourth, price elasticity/cost sensitivity is different. User-side home energy storage is similar to brand consumption, with a certain premium capacity and a higher price tolerance than power side and power grid side energy storage. A typical example is Tesla Powerwall, which is in short supply and repeatedly increases in price. The latter is a means of production, pursues IRR and is more sensitive to cost, so Peoneng technology has a better profit performance.

Fifth, the cost performance of Lithium Batteries for energy storage still needs to be improved. On the one hand, the cost of lithium battery increases rather than decreases; on the other hand, the energy storage scenario still needs to improve the safety, energy density, cycle times and other characteristics of lithium battery, especially the new energy storage side has a high requirement on cycle times. This is true of relatively mature lithium-ion batteries, but other non-lithium-ion technologies such as sodium have lower life-cycle costs, higher cost per kilowatt hour, lower energy density, fewer cycles, and so on.

Sixth, the business model is constantly optimized to get rid of the risk of material price fluctuations. Since last year, the cost of lithium electric materials has soared, and gradually transmitted to lithium batteries, resulting in a tight supply of lithium batteries, energy storage enterprises generally face cost and delivery pressure. Last year, Sunshine Power paid penalties for failing to deliver as contracted. At present, some energy storage enterprises began to link their business orders with the price of upstream lithium resources to get rid of the risk of material price fluctuations.

Seventh, the market is relatively scattered, channel and brand advantages are obvious. At present, home energy storage in North America, Europe, Australia, Japan and other regions is gradually mature, new energy side energy storage in North America, South America, Australia, China and other regions began to increase in volume, the domestic new energy side energy storage market is divided into various provinces and cities. In the face of decentralized global energy storage market, channels and brands are important competitiveness, so different types of energy storage players need to build their own competitive advantages and achieve industrial division of labor.

With the transformation of energy system to power and power system to new energy, new energy storage is becoming the key link of new power system in the wave of "carbon neutrality".

However, with the price of lithium battery rising rather than falling recently, the cost of lithium energy storage is high, and the new market mechanism of energy storage is still not perfect, with high enthusiasm, weak profits and poor popularity, the enthusiasm of energy storage investment is being troubled.

How to promote energy storage? Is the current energy storage industry is the most worthy of thinking about the topic, this public account published last month "High cost, Energy storage How to solve the problem?" , and put forward a solution is to break through the "new energy + energy storage" market mechanism, through the "great shift" type of cost dredging to indirectly solve the cost of energy storage, so as to solve the problem.

Only by allowing the development of energy storage industry with quality can it achieve long-term sustainable growth in quantity, so as to avoid the dilemma of white-hot industry before it develops.

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.